Essay

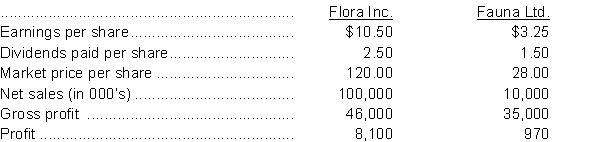

The following information for 2014 is provided for two public companies in the same industry:

Instructions

Answer the following questions about the two companies. Use the information provided to calculate the ratios needed to support your answers.

a. Based on the above information, which company is more profitable?

b. About which company are investors more optimistic?

c. In which company would investors prefer to buy shares for growth potential? In which company would they prefer to buy shares if their goal is dividend income?

Correct Answer:

Verified

a. Fauna's profit margin is 9.7% ($970 ÷...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q121: In a horizontal analysis, if an item

Q122: Which one of the following would NOT

Q123: Selected data from O'Brien Ltd. are presented

Q124: The profit margin is calculated by dividing<br>A)

Q125: Shareholders are most interested in evaluating<br>A) liquidity

Q128: Bradley Corporation had the following comparative current

Q129: The following are income statements of two

Q130: If a company has an acid-test ratio

Q131: A liquidity ratio measures the<br>A) operating success

Q184: A successful grocery store would probably have<br>A)