Essay

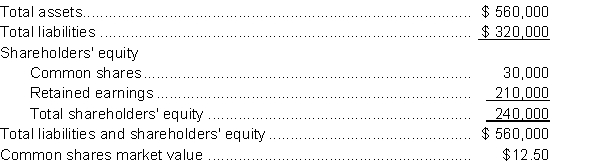

The following is information taken from the shareholders' equity section of the projected summary financial statements of Blair Bonds Corp. to December 31, 2014, prior to the board of directors' meeting to decide on dividends or other share transactions related to its 10,000 issued common shares for the year.  Instructions

Instructions

Prepare in four-column comparative format, the shareholders' equity section as it would appear under each of the following possible options that the board is considering. Only one of the options will be chosen, so assume they are mutually exclusive. Describe any additional disclosure that would be required.

a. The board declares a 20% stock dividend.

b. The board approves a 3-for-1 stock split.

Correct Answer:

Verified

Additional disclosure in each...

Additional disclosure in each...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q4: When a company reacquires shares at a

Q5: Accumulated other comprehensive income is reported in

Q6: Common Stock Dividends Distributable is classified as<br>A)

Q7: When an operation is discontinued, the disposal

Q8: Chan Inc. has a profit of $1,000,000

Q10: At December 31, 2014, Sookie Limited has

Q11: When a company reacquires its own shares

Q12: To calculate the weighted average number of

Q13: Lake Ltd. was incorporated July 1, 2013.

Q14: Westcock Shipbuilding Ltd. has a December 31