Essay

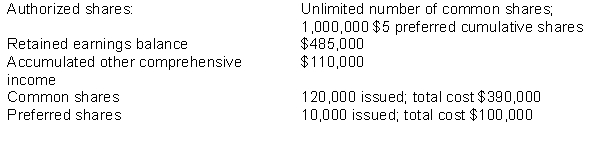

On January 1, 2014, the following information appears in the records of Boultin Holdings Inc.:  During the year, the company had the following transactions:

During the year, the company had the following transactions:

Mar 31 Declared cash dividends on common shares of $0.50 per share; payable to shareholders of record on April 10, and payable on April 25.

Jun 30 Declared the entire annual dividend required on preferred shares; payable to shareholders of record on July 15, and payable on July 31.

Sep 15 Declared a 10% stock dividend to shareholders of record on October 5, and distributable on October 15.

All dividends were paid or distributed on the due date.

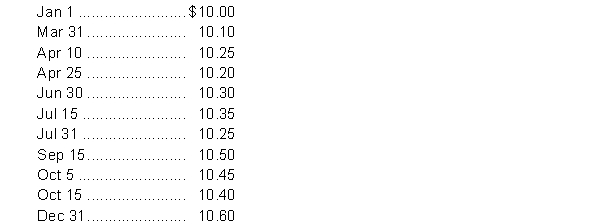

Market price of Boultin's common shares at various dates was as follows:  At December 31, 2014 the accounting records indicate that Boultin's profit for 2014 was $350,000 and other comprehensive income, consisting of a gain on fair value adjustments on equity investments was $28,000.

At December 31, 2014 the accounting records indicate that Boultin's profit for 2014 was $350,000 and other comprehensive income, consisting of a gain on fair value adjustments on equity investments was $28,000.

Instructions

a. Journalize the dividend transactions.

b. Prepare the statement of changes in shareholders equity for the year ended December 31, 2014.

c. Prepare the shareholders' equity section of Boultin's balance sheet at December 31, 2014.

Correct Answer:

Verified

Correct Answer:

Verified

Q82: The entry to record the reacquisition of

Q83: When calculating earnings per share, the amount

Q84: On January 1, 2014, Chu Corporation had

Q85: Under IFRS, a company has two options

Q86: Which of the following describes how comprehensive

Q88: The statement of changes in shareholders' equity

Q89: Basic earnings per share and fully diluted

Q90: On January 1, 2014, Only You Merchandise

Q91: Saha Company had profit of $1,020,000 for

Q92: Under IFRS the following account is included