Essay

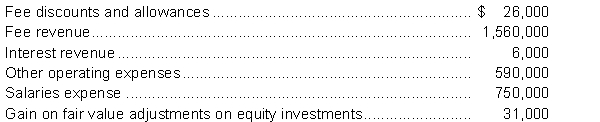

The following information is available from the accounting records of DeWitt Engineering Ltd. for the year ended June 30, 2014:  Instructions

Instructions

Prepare a combined Statement of Income and Comprehensive Income for the year ended June 30, 2014. The company has a 30% income tax rate and records gains and losses on equity investments as other comprehensive income.

Correct Answer:

Verified

Correct Answer:

Verified

Q70: The general concept of "let the tax

Q71: A correction of a prior period error

Q72: At January 1, 2013, Karpo Corporation had

Q73: On January 1, 2014, Grieve Grocers Inc.'s

Q74: A stock split<br>A) may occur in the

Q76: Price Earnings ratio is calculated as the

Q77: All of the following are included in

Q78: The ratio that indicates the percentage of

Q79: Prior period adjustments should be made for

Q80: RD Holdings Ltd. which has authorized share