Essay

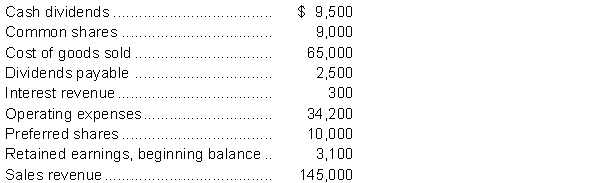

The following information is taken from the trial balance of GlaxonSmith Supplies Ltd. at December 31, 2014, the company's year end. GlaxonSmith has a 25% tax rate. One of the entries making up the balance of retained earnings is an adjustment that was required due to the overstatement of prior year's depreciation expense by $1,600 which is net of tax effect.  Instructions

Instructions

Prepare the income statement and statement of retained earnings for GlaxonSmith for the year ended December 31, 2014 using the multiple-step format for the income statement.

Correct Answer:

Verified

Correct Answer:

Verified

Q117: At January 1, 2013, Jones Corporation had

Q118: The change in 2011 from Canadian GAAP

Q119: The market price of Sanji's Paper Inc.'s

Q120: Prior period adjustments are reported<br>A) in the

Q121: A stock dividend will reduce retained earnings.

Q123: Jacobs Corporation has the following shareholders' equity

Q124: Correction of errors would always result in

Q125: A prior period adjustment for understatement of

Q126: Oswala Inc. had the following balances in

Q127: In discontinued operations reporting, the amounts shown