Essay

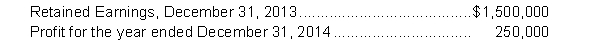

The following information is available for Reynolds Corporation:  The company accountant, in preparing financial statements for the year ending December 31, 2014, has discovered the following information:

The company accountant, in preparing financial statements for the year ending December 31, 2014, has discovered the following information:

The company's previous bookkeeper, who has been fired, had recorded depreciation expense on a machine in 2012 and 2013 using the double diminishing-balance method of depreciation. The bookkeeper neglected to use the straight-line method of depreciation which is the company's policy. The cumulative effect of the error on prior years was $9,000. Depreciation was calculated by the straight-line method in 2014. Reynolds' average tax rate is 22%. During 2014, Reynolds declared and paid cash dividends of $80,000.

Instructions

a. Calculate the impact on retained earnings.

b. Prepare the statement of retained earnings for 2014.

Correct Answer:

Verified

a. Retained Earnings...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q102: A stock split will usually result in

Q103: The correction of a prior period error

Q104: A stock dividend makes no difference to

Q105: The board of directors generally assigns a

Q106: Gabrial Ltd. was incorporated February 1, 2014

Q108: Appier Corporation had the information listed below

Q109: When stock dividends are distributed,<br>A) Common Stock

Q110: A shareholder who receives a stock dividend

Q111: In the statement of changes in shareholders'

Q112: At the declaration date, the stock dividend