Essay

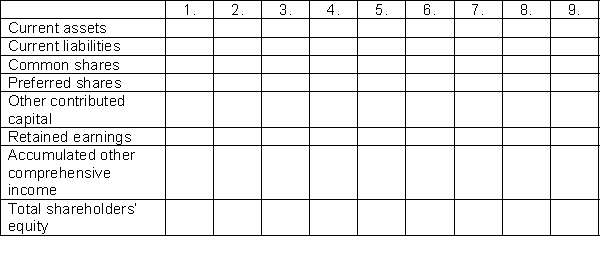

Connolly Corporation had the following events during one fiscal year:

1. A stock dividend is declared on common shares.

2. The stock dividend is distributed.

3. Other comprehensive income for the year totals $350,000.

4. Cash dividends are declared.

5. The cash dividends are paid.

6. Profit for the year is $1,500,000.

7. Prior year's profit had to be corrected to record additional revenue that had been earned, but which had not yet been paid for by the customer. The additional revenue increases the amount of taxes payable on the prior year's income.

8. Repurchased common shares for an amount less than their average cost.

9. One third of the preferred shares are converted to common shares on a 1:10 ratio.

Instructions

Using the table provided, for each of the following financial statement categories, indicate the effect of the transaction as follows:

Correct Answer:

Verified

Correct Answer:

Verified

Q126: Oswala Inc. had the following balances in

Q127: In discontinued operations reporting, the amounts shown

Q128: Match the items below by entering the

Q129: Which of the following statements is correct?<br>A)

Q130: Comprehensive income includes all changes in shareholders

Q131: What is the total shareholder's equity based

Q132: Stock dividends and stock splits have the

Q134: Lee Holdings Ltd. was incorporated on January

Q135: Juan Inc. has 1,000 common shares issued

Q136: The following information is available regarding a