Essay

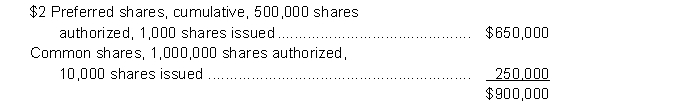

At January 1, 2014, Morrisey Corporation had the following share capital. At that time no preferred dividends were in arrears:  On July 1, 2014, the board of directors declared and paid a $1.50 cash dividend on common shares, and the full annual dividend to which the preferred shareholders were entitled. On October 1, 2014, Morrisey sold an additional 80,000 common shares for proceeds of $280,000. The corporation earned $650,000 during the year.

On July 1, 2014, the board of directors declared and paid a $1.50 cash dividend on common shares, and the full annual dividend to which the preferred shareholders were entitled. On October 1, 2014, Morrisey sold an additional 80,000 common shares for proceeds of $280,000. The corporation earned $650,000 during the year.

Instructions

a. Calculate Morrisey's earnings per share for 2014.

b. Calculate Morrisey's total dividend payout ratio for 2014.

Correct Answer:

Verified

a. ($650,000 - [$2 x 1,000]) ÷...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q20: At January 1, 2013, Karpo Corporation had

Q21: A prior period adjustment that corrects profit

Q22: Retained earnings are always shown in before

Q23: Corporations generally issue stock dividends in order

Q24: What would be the effect of a

Q26: Which one of the following events would

Q27: At January 1, 2013, Leblanc Corporation had

Q28: A stock split will increase share capital.

Q29: Identify the effect the declaration of a

Q30: In a 2 for 1 stock split,