Essay

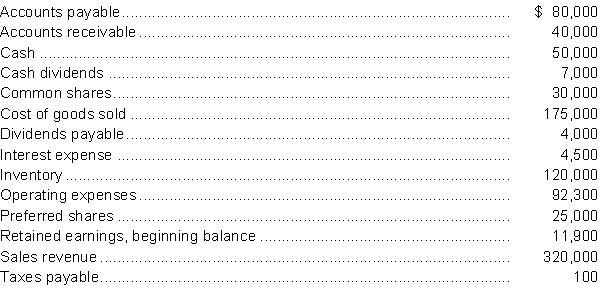

The trial balance of Terris Inc. for the year ended September 30, 2014, prior to recording of tax expenses, but after all other adjustments, is as follows. All accounts are their normal balance (debit or credit). Terris has a tax rate of 30%.  Instructions

Instructions

Prepare the income statement and statement of retained earnings for Terris Inc. for the year ended September 30, 2014.

Correct Answer:

Verified

Correct Answer:

Verified

Q152: Contributed capital of a company includes share

Q153: Which of the following is NOT true

Q154: Lee Holdings Ltd. was incorporated on January

Q155: Dividends in arrears on cumulative preferred shares<br>A)

Q156: Moreland Holdings Inc. has authorized share capital

Q158: A cash dividend account is never closed

Q159: Baden Corporation is a publicly held corporation

Q160: The date at which ownership is determined

Q161: Dividends in a corporation are the equivalent

Q162: The shareholders of a corporation pay tax