Essay

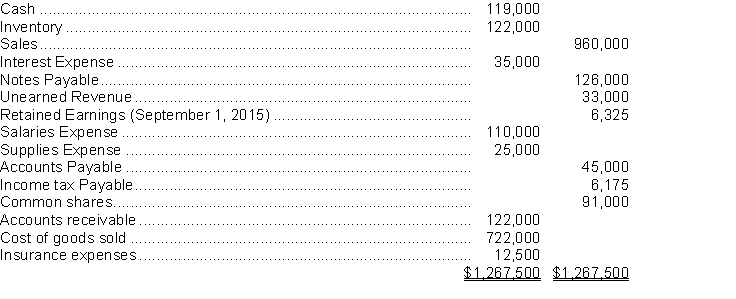

Maki and Levesque Inc. has recorded all necessary adjusting entries, except for income tax expense, at its fiscal year end August 31, 2016. The following information has been taken from the adjusted trial balance:  Maki and Levesque Inc. has a 15% tax rate.

Maki and Levesque Inc. has a 15% tax rate.

Instructions

a. Prepare a multi step income statement and the required journal entry to adjust income tax expense.

b. Prepare a statement of retained earnings.

c. Prepare closing entries.

Correct Answer:

Verified

Correct Answer:

Verified

Q101: KBR Investments Inc. has issued 90,000 Class

Q102: What is the closing entry required for

Q103: Profit for Sandos Inc., was $10,000 in

Q104: Share capital may be distributed to shareholders

Q105: Indicate the respective effects of the declaration

Q107: Mayer corporation, a private company reporting under

Q108: Norton Corporation has the following shareholders equity

Q109: On January 1, 2014, Mandy Merchandise Ltd.

Q110: Which one of the following is NOT

Q111: The statement of retained earnings<br>A) reports the