Essay

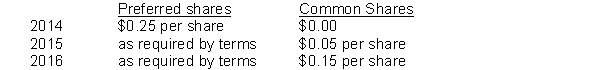

Trainor Corporation was organized on January 1, 2014. During its first year, the corporation issued 20,000 preferred shares with a $0.30 dividend entitlement and 200,000 common shares, both at $1 per share. At December 31, the corporation's year end, Trainor declared the following cash dividends:  Instructions

Instructions

a. Calculate the total dividends and the amount paid to each class of shares, assuming the preferred dividend is not cumulative.

b.

b. Calculate the total dividends and the amount paid to each class of shares, assuming the preferred dividend is cumulative.

c. Journalize the declaration of the cash dividend at December 31, 2015 using the assumption of part

Correct Answer:

Verified

Correct Answer:

Verified

Q164: A credit balance in retained earnings represents<br>A)

Q165: The authorization of share capital does not

Q166: Shares can be issued only in exchange

Q167: Norton Corporation has the following shareholders equity

Q168: A corporate board of directors generally<br>A) select

Q170: Dividends Payable is classified as a<br>A) non-current

Q171: Allen Barron has invested $800,000 in a

Q172: Kis Corp. declared $35,000 in dividends in

Q173: Which of the following statements reflects the

Q174: If a corporation has only one class