Essay

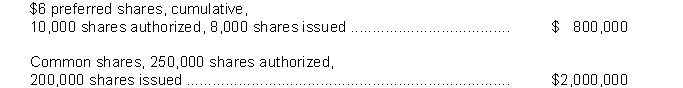

The shareholders' equity section of Karr Corporation at December 31, 2013 included the following:  Dividends were not declared on the preferred shares in 2013 and are in arrears.

Dividends were not declared on the preferred shares in 2013 and are in arrears.

On September 15, 2014, the board of directors of Karr Corporation declared dividends on the preferred shares for 2013 and 2014, to shareholders of record on October 1, 2014, payable on October 15, 2014.

On November 1, 2014, the board of directors declared a $2 per share dividend on the common shares, payable November 30, 2014, to shareholders of record on November 15, 2014.

Instructions

Prepare the journal entries that should be made by Karr Corporation in 2014 on the dates indicated below:

Correct Answer:

Verified

Correct Answer:

Verified

Q185: The ownership of the shares is determined

Q186: Issued shares are the number of<br>A) authorized

Q187: On the dividend's date of record<br>A) a

Q188: Corporations must pay taxes as a legal

Q189: Common shares usually have a cumulative dividend

Q190: A privately held corporation can also be

Q191: A cumulative dividend feature will mean that

Q193: The following items were shown on the

Q194: Gabrial Ltd. was incorporated February 1, 2013

Q195: Corporate tax rates are typically<br>A) higher than