Essay

The following unadjusted balances are taken from the trial balance of Jackson Equipment at December 31, 2014:  Jackson Equipment sells and installs security systems. Beginning on December 1, 2014, Jackson began offering a 2-year product warranty. Based on research in the industry, Jackson's management believes that 5% of security systems will require some warranty work and that the typical costs for systems requiring warranty work will be $875 during the first year and $325 during the second year. In December, Jackson supplied and installed 80 systems.

Jackson Equipment sells and installs security systems. Beginning on December 1, 2014, Jackson began offering a 2-year product warranty. Based on research in the industry, Jackson's management believes that 5% of security systems will require some warranty work and that the typical costs for systems requiring warranty work will be $875 during the first year and $325 during the second year. In December, Jackson supplied and installed 80 systems.

Instructions

a. Calculate and record Jackson's warranty liability at December 31, 2014.

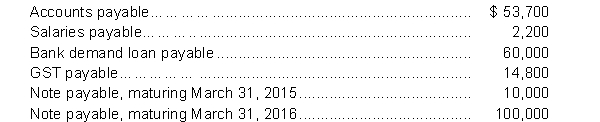

b. Prepare the current liability portion of Jackson's balance sheet at December 31, 2014.

Correct Answer:

Verified

a.

80 syst...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

80 syst...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q62: Canadian Tire Money represents a liability to

Q63: After the warranty liability has been established,

Q64: Disclosure of a contingent loss is usually

Q65: Companies who are reporting under IFRS will

Q66: If a note payable is payable in

Q68: A bank overdraft is the same as

Q69: Elliott Company had the following transactions

Q70: Most companies pay current liabilities<br>A) out of

Q71: Liabilities with a known amount, payee and

Q72: Under the expense approach, the warranty liability