Essay

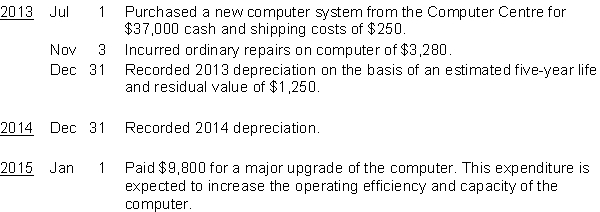

Kelso Word Processing Service uses the straight-line method of depreciation. The company's fiscal year end is December 31. The following transactions and events occurred during the first three years.  Instructions

Instructions

Prepare the necessary entries. (Show calculations.)

Correct Answer:

Verified

Correct Answer:

Verified

Q66: Annual depreciation expense needs to be revised

Q67: Wu's Copy Shop bought equipment for $16,000

Q68: CRA does NOT allow taxpayers to estimate

Q69: Natural resources are frequently referred to as

Q70: The carrying amount of a long-lived asset

Q72: Research costs<br>A) are classified as intangible assets.<br>B)

Q73: Depreciation is a process of cost allocation.

Q74: Pugwash Company has decided to change the

Q75: The expenditures necessary to bring the asset

Q76: A company purchases a remote site building