Essay

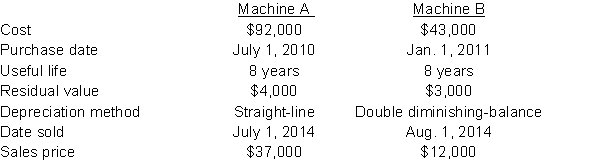

Winningham Company sold the following two machines in 2014:  Instructions

Instructions

Journalize all entries required to update depreciation and record the sales of the two assets in 2014. The company has recorded depreciation on the machine to December 31, 2013.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q49: A basket purchase of long-lived assets requires

Q50: A company purchased a delivery truck for

Q51: Under IFRS, at each year end, the

Q52: Merry Clinic purchases land for $80,000 cash.

Q53: Additions and improvements to a long-lived asset

Q55: Assets are depreciated over their useful lives

Q56: Johansan Mining Company purchased a mine for

Q57: The first step in recording a disposal

Q58: A company sells a long-lived asset which

Q59: A patent can be renewed<br>A) every twenty