Essay

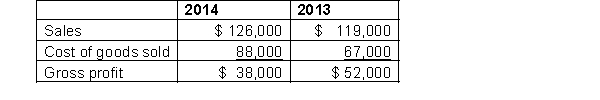

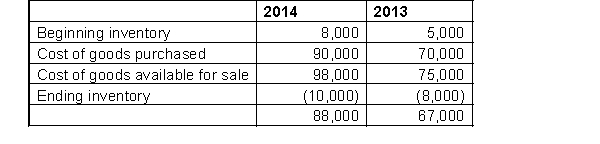

Winston Auto Parts reported the following information in its income statement for 2013 and 2014:  Additional Information:

Additional Information:  While completing Winston's 2015 financial statements, the accountant realized that errors had been made in previous years' inventory calculations. The correct ending inventory at December 31, 2012 was $6,000, the correct ending inventory at December 31, 2013 was $4,000, and the correct ending inventory at December 31, 2014 was $7,000.

While completing Winston's 2015 financial statements, the accountant realized that errors had been made in previous years' inventory calculations. The correct ending inventory at December 31, 2012 was $6,000, the correct ending inventory at December 31, 2013 was $4,000, and the correct ending inventory at December 31, 2014 was $7,000.

Instructions

a. Calculate the correct cost of goods sold and gross profit for 2013 and for 2014.

b. Calculate the inventory turnover for 2013 and 2014:

(i) using the originally reported information; and

(ii) using the corrected information.

c. Calculate the gross profit margin for 2013 and 2014:

(i) using the originally reported information; and

(ii) using the corrected information.

d. Explain how the errors will have caused management performance to be improperly evaluated.

Correct Answer:

Verified

a.

COGS calculated as follows:

COGS calculated as follows:

b. (i...

b. (i...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q110: An overstatement of the cost of goods

Q111: Benjaha Company is preparing the annual financial

Q112: If the ending inventory is understated then

Q113: Karr Company has a beginning merchandise inventory

Q114: If goods in transit are shipped FOB

Q116: Levy's Used Cars uses the specific identification

Q117: The evidence required for a reversal of

Q118: A company just starting business made the

Q119: A company just starting in business purchased

Q120: While goods purchased FOB destination, and shipped