Essay

The new accountant for Wilson's Giftware was in a hurry to record the transactions for the month of March, and made the following errors:

1. February utilities of $560 had been recorded as an Account Payable in February. When the account was paid in March, the accountant recorded the payment as a debit to Utilities Expense and a credit to Cash.

2. March 15th salaries totalling $4,750 were recorded as a debit to Supplies instead of to Salaries Expense.

3. A customer payment in the amount of $1,200 was credited to Accounts Receivable. However the sale had never been invoiced or recorded and was a cash sale.

4. Samra Wilson withdrew $800 for personal use. The accountant recorded the entry as a debit to Cash and a credit to S. Wilson, Drawings.

Instructions:

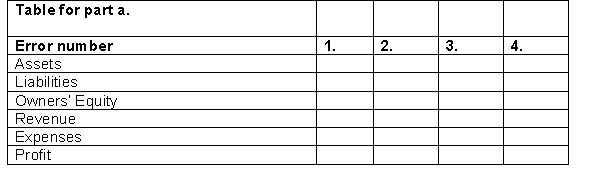

a. For each of the four errors, indicate the effect of the error on the balance sheet and income statement, indicating whether the assets, liabilities, owner's equity, revenue, expenses, and Profit are overstated (O), understated (U), or not affected (NA). Use the table below for your answer.

b. For each of the four errors, prepare the correcting entries required at March 31.

Correct Answer:

Verified

Correct Answer:

Verified

Q33: The two optional steps in the accounting

Q72: Both correcting entries and adjusting entries always

Q130: On August 1, Rothesay Boat Club provided

Q132: Which of the following will be affected

Q134: On December 31, 2014 selected accounts of

Q136: When constructing a work sheet, accounts are

Q137: Queenstown Marina noticed an error in their

Q137: The final step in the accounting cycle

Q138: A reversing entry is made at the

Q139: Closing entries are journalized and posted<br>A) before