Essay

When preparing the December 31 year-end financial statements for Style Design, the following errors were discovered:

1. On January 1, equipment was purchased for $10,000 which was expected to have a useful life of 4 years. The accountant recorded depreciation expense (in the correct accounts) as $250.

2. A bank loan of $9,000 was taken on December 1, and the funds were deposited directly to Style's bank account. The accountant recorded the deposit as a debit to Cash and a credit to Revenue. The loan is at 6% and no interest has yet been paid or recorded.

3. A customer payment in the amount of $450 was credited to Accounts Receivable and debited to Cash in the amount of $540.

4. Salaries expenses of $2,200 were recorded as a credit to Cash and a debit to Telephone Expense.

5. A payment of $3,500 made to a supplier on account was debited to Supplies instead of to Accounts Payable. This error was discovered before Supplies expense was adjusted to year-end actual balance.

Instructions

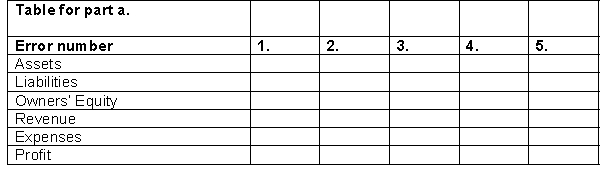

a. For each of the errors, indicate the effect of the error on the balance sheet and income statement, indicating whether the assets, liabilities, owner's equity, revenue, expenses, and profit are overstated (O), understated (U), or not affected (NA). Use the table below for your answer.

b. For each of the errors, prepare the correcting entries required at December 31.

Correct Answer:

Verified

Correct Answer:

Verified

Q105: Listed below are some of the steps

Q106: The following errors were made in April

Q107: Which of the following is an example

Q108: Below is an adjusted trial balance. <img

Q109: Office Equipment is classified in the balance

Q111: Crimmins Boats paid a $350 cheque to

Q112: The trial balances of Grant Company follow

Q113: On a classified balance sheet of a

Q114: Assuming that there is a loss for

Q115: The owner's capital account is<br>A) a permanent