Essay

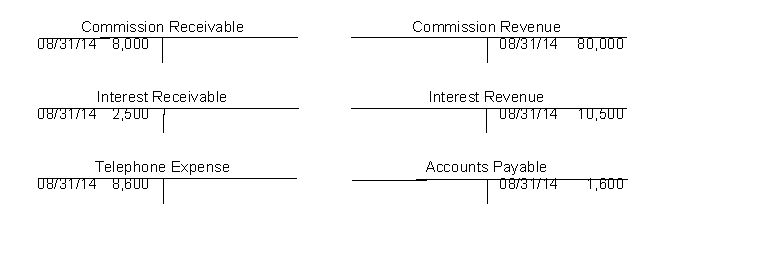

On August 31, 2014 selected accounts of Grand Falls Potatoes, after all year end adjusting entries, show the following data:  Analysis indicates that adjusting entries were made for

Analysis indicates that adjusting entries were made for

1. $8,000 of commission revenue earned but not billed,

2. $2,500 of accrued but interest not received, and

3. $1,600 of telephone expense accrued but not paid.

Instructions

a. Prepare the closing entries at August 31, 2014.

b. Prepare the reversing entries on September 1, 2014.

c. Prepare the entries to record (1) the collection of the accrued commission on September 15, (2) payment of the telephone bill on September 10, and (3) receipt of all the interest due ($4,200) on September 15.

d. What is the interest revenue for the month of September 2014?

Correct Answer:

Verified

Correct Answer:

Verified

Q91: The current portion of a long-term liability

Q92: When preparing a worksheet, the profit (or

Q93: The heading for a post-closing trial balance

Q95: The difference between current assets and current

Q97: The balance of the Depreciation Expense account

Q98: A post-closing trial balance will show<br>A) only

Q99: Instructions<br>Beside each step determine if the step

Q100: Closing entries are necessary if the business

Q101: The adjusted trial balance for DVD Concepts

Q233: Closing revenue and expense accounts to the