Essay

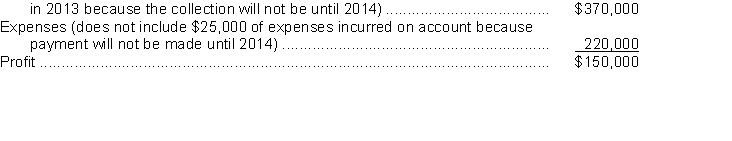

Roberts Company prepared the following income statement using the cash basis of accounting:

ROBERTS COMPANY

Income Statement, Cash Basis

Year Ended December 31, 2013

_____________________________________________________________________________

Service revenue (does not include $40,000 of services performed on account  Additional data:

Additional data:

1. Depreciation on a company automobile for the year amounted to $6,000. This amount is not included in the expenses above.

2. On July 1, 2013, paid for a one-year insurance policy on the automobile amounting to $1,800. This amount is included in the expenses above.

Instructions

a. Prepare Roberts Company's income statement on the accrual basis in conformity with generally accepted accounting principles. Show calculations and explain each change.

b. Explain which basis (cash or accrual) provides a better measure of profit.

Correct Answer:

Verified

a.

b. The accrual basis of accounting ...

b. The accrual basis of accounting ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q22: On Friday of each week, Gruppe Company

Q23: Lamburg Company has prepared the following adjusting

Q25: Many business transactions will affect more than

Q26: Prepayments must always be debited to an

Q28: Prepayments are always made with cash.

Q29: In the adjusted trial balance, if some

Q30: Pierson Insurance Agency prepares monthly financial statements.

Q31: Ove is a lawyer who requires that

Q32: An adjusting entry will credit a liability

Q66: Accumulated Depreciation is<br>A) an expense account.<br>B) an