Essay

The Upton Company accumulates the following adjustment data at December 31.

1. Revenue of $1,100 collected in advance has been earned.

2. Salaries of $600 are unpaid.

3. Prepaid rent totalling $450 has expired.

4. Supplies of $550 have been used.

5. Revenue earned but unbilled totals $750.

6. Utility expenses of $300 are unpaid.

7. Interest of $250 has accrued on a note payable.

Instructions

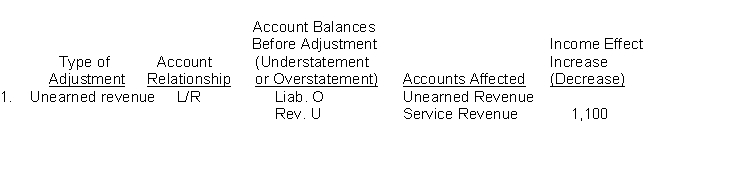

a. For each of the above items indicate:

i. The type of adjustment (prepaid expense, unearned revenue, accrued revenue, or accrued expense).

ii. The account relationship (asset/liability, liability/revenue, etc.).

iii. The status of account balances before adjustment (understatement or overstatement).

iv. The accounts that will be affected.

v. The profit effect.

Prepare your answer in the tabular form presented below. The first item is shown for illustrative purposes.

b. Assume Profit before the adjustments listed above was $21,500. What is the adjusted Profit?

Correct Answer:

Verified

Correct Answer:

Verified

Q121: Which of the following accounting periods would

Q122: On June 28, Bronnie's provided consulting services

Q123: The accrual basis of accounting is more

Q124: Pooley Electric Company purchased office supplies costing

Q127: When a prepayment is made for an

Q128: If the debits equal the credits in

Q129: The cash basis of accounting is more

Q130: The Boltenhouse Museum paid employee wages on

Q131: Expense recognition is tied to revenue recognition

Q249: Unearned revenue is a prepayment that requires