Essay

Ellis Company accumulates the following adjustment data at December 31.

1. Fees of $800 collected in advance have been earned.

2. Salaries of $600 are unpaid.

3. Prepaid rent totalling $450 has expired.

4. Supplies of $550 have been used.

5. Fees earned but unbilled total $750.

6. Utility expenses of $200 are unpaid.

7. Interest of $250 has accrued on a note payable.

8. Depreciation of office equipment is $300.

Instructions

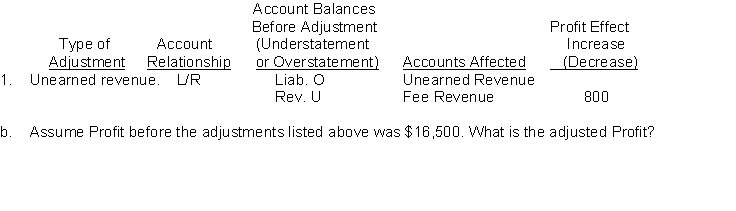

a. For each of the above items indicate:

i. The type of adjustment (prepaid expense, unearned revenue, accrued revenue, or accrued expense).

ii. The account relationship (asset/liability, liability/revenue, etc.).

iii. The status of account balances before adjustment (understatement or overstatement).

iv. The accounts that will be affected.

v. The profit effect.

Prepare your answer in the tabular form presented below. The first item is shown for illustrative purposes.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Percy's Kitchens paid $18,200 for a one-year

Q2: Match the items below by entering the

Q3: Because accounting often requires estimates to be

Q4: Which of the following is NOT a

Q6: In calculating depreciation, the number of years

Q7: The following situations are independent:<br>1. Jane's Drywall

Q8: A new accountant working for Amherst Sobey's

Q10: In 2013, Micro Marvels signed a $70,000

Q110: Prepaid expenses are<br>A) paid and recorded in

Q149: The cash basis of accounting is not