Essay

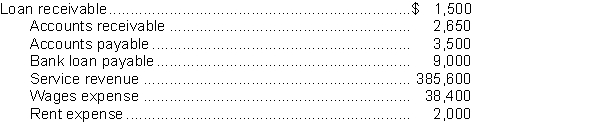

In January 2014, Edward started a business providing home repair services. The business is called Helpful Handyman, and the service is so popular that he has already hired 10 additional employees after being in business for just six months. On May 1 he rented an office with storage space for tools and supplies. It is now the end of June and he must prepare financial statements to present to his banker. The following amounts are taken from Helpful Handyman's unadjusted trial balance at June 30, 2014. Assume all accounts are their normal balance (Debit or Credit).  Additional information about the accounting records:

Additional information about the accounting records:

1. The loan receivable was made to an employee on June 1 and the employee is to pay interest at 12% annually in monthly instalments starting July 1.

2. Edward normally invoices customers when the jobs are complete. At June 30, there was $5,000 of work that had been completed near month end for which invoices had not yet been issued.

3. The bank loan bears interest at 6% and was taken out on April 1. Interest payments are due quarterly, so no interest has yet been paid.

4. The last pay day before June 30 was on June 25. Since then, the 10 employees have worked an average of 25 hours each, at a wage of $8.50 per hour.

5. Rent is $2,000 per month. The June rent has not yet been paid.

Instructions:

a. Prepare any adjusting entries required at June 30, 2014 based on the above information. Accounts not listed above may need to be set up.

a. Indicate whether the ending balances are Debit or Credit.

b. Calculate the adjusted balances of the accounts listed above and any new accounts set up in part

c. Assuming that unadjusted Profit of Helpful Handyman is $60,000. Calculate the adjusted Profit after the adjustments above have been made.

Correct Answer:

Verified

Correct Answer:

Verified

Q13: The Kookie Kutter Bakery purchased $6,500 worth

Q14: A company is required to prepare adjusting

Q15: Adjusting journal entries are only necessary when

Q16: In 2013, Florenceville Potatoes signed a $50,000

Q20: The balance sheets of Yin Company include

Q21: Patterson Realty Company received a cheque for

Q22: On Friday of each week, Gruppe Company

Q23: Lamburg Company has prepared the following adjusting

Q104: A company usually determines the amount of

Q202: An adjusting entry always involves two balance