Essay

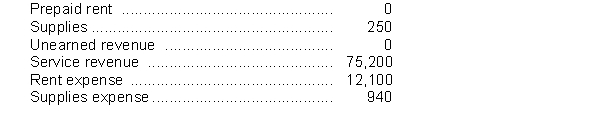

The following amounts are taken from the unadjusted trial balance of Woodstock Company at its year end, April 30 and are their normal balance (debit or credit). Woodstock records all prepaid expenses and revenue in their respective expense or revenue accounts when paid or received. Woodstock records adjusting entries annually when preparing its year end financial statements.  The following transactions are included in the above account balances:

The following transactions are included in the above account balances:

1. On April 1, through a $2,100 cheque, Woodstock's accountant paid both April and May rent and posted the full amount to Rent Expense

2. On April 22 supplies were purchased on account for $740. On April 30 a count of actual supplies on hand shows the remaining supplies to be $81.

3. On January 1 a customer paid $8,000 in advance for a service contract. As of April 30 the work was 40% complete.

Instructions

a. Journalize the transactions described as (1) through (3). Include the date, but no explanation is required.

b. Prepare any adjusting entries required at April 30.

c. Determine the adjusted ending balances of the accounts listed above. Indicate whether the ending balance is a debit or credit.

d. Assuming that profit before adjusting entries were made is $12,850, calculate the adjusted profit.

Correct Answer:

Verified

Correct Answer:

Verified

Q59: Tantramar Construction has an October 31 year

Q60: To decrease an unearned revenue account, a

Q61: An adjusting entry will always debit an

Q62: Once an unadjusted trial balance has been

Q63: A dress shop makes a large sale

Q65: The fiscal year of the company must

Q66: Expenses should be recognized, excluding transactions with

Q67: Presented below are the trial balance and

Q68: Revenue will be recognized when the following

Q69: The following ledger accounts are used by