Essay

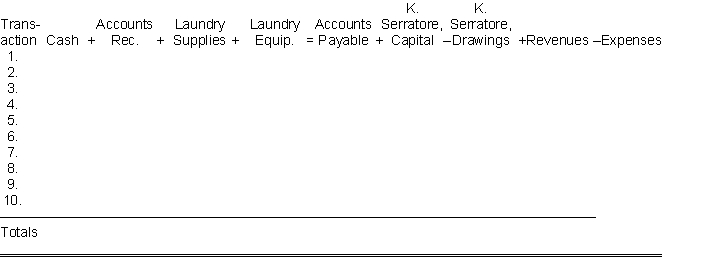

Ken Serratore decides to open a cleaning and laundry service near the local college campus that will operate as a proprietorship. The transactions for the month of June are listed below:

1. Ken Serratore invests $20,000 in cash to start a cleaning and laundry business on June 1.

2. Purchased laundry equipment for $5,000 paying $3,000 in cash and the remainder due in 30 days.

3. Purchased laundry supplies for $1,200 cash.

4. Received a bill from Campus News for $300 for advertising in the campus newspaper.

5. Cash revenue from customers for cleaning and laundry amounted to $1,500.

6. Paid salaries of $200 to student workers.

7. Billed the Tiger Football Team $100 for cleaning and laundry services.

8. Paid $300 to Campus News for advertising that was previously billed in Transaction 4.

9. Ken Serratore withdrew $700 from the business for living expenses.

10. Incurred utility expenses for month on account, $400.

Instructions

Analyze the transactions above in terms of their effect on the basic accounting equation. Record each transaction by increasing (+) or decreasing (-) the dollar amount of each item affected. Total and balance the equation at the end of the month.

Correct Answer:

Verified

Correct Answer:

Verified

Q47: Shareholders' equity, in a corporation, is increased

Q48: A balance sheet presents the revenues and

Q49: Publicly Traded Corporations can choose to report

Q50: For each of the following, describe a

Q51: Calculate the missing amount in each category

Q54: 1.Explain the going concern assumption. How is

Q55: Jackson's Small Engine Repair Shop, a proprietorship,

Q56: Owner's equity, in a proprietorship, is increased

Q57: ASPE requires less information on the financial

Q221: The partnership form of business organization<br>A) is