Multiple Choice

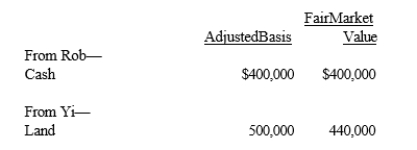

Rob and Yi form Bluebird Corporation with the following investments.  Each receives 50% of Bluebird's stock. In addition, Yi receives cash of $40,000. One result of these transfers is that Yi has a:

Each receives 50% of Bluebird's stock. In addition, Yi receives cash of $40,000. One result of these transfers is that Yi has a:

A) Recognized loss of $60,000.

B) Recognized loss of $20,000.

C) Basis of $460,000 in the Bluebird stock (assuming Bluebird reduces its basis in the land to $440,000) .

D) Basis of $400,000 in the Bluebird stock (assuming Bluebird reduces its basis in the land to $440,000) .

E) None of these.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: When Pheasant Corporation was formed under §

Q2: Hunter and Warren form Tan Corporation. Hunter

Q3: Kim, a real estate dealer, and others

Q5: How is the transfer of liabilities in

Q6: Ira, a calendar year taxpayer, purchases as

Q7: Under Federal tax law, a bias for

Q8: Karen formed Grebe Corporation with an investment

Q9: Earl and Mary form Crow Corporation. Earl

Q10: Kirby and Helen form Red Corporation. Kirby

Q11: Joe and Kay form Gull Corporation. Joe