Multiple Choice

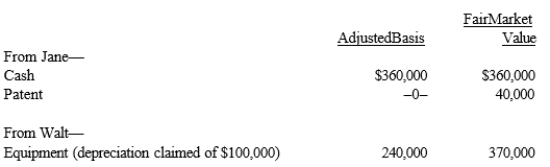

Four individuals form Chickadee Corporation under § 351. Two of these individuals, Jane and Walt, made the following contributions:  Both Jane and Walt receive stock in Chickadee Corporation equal to the value of their investments.

Both Jane and Walt receive stock in Chickadee Corporation equal to the value of their investments.

A) Jane must recognize income of $40,000; Walt has no income.

B) Neither Jane nor Walt recognize income.

C) Walt must recognize income of $130,000; Jane has no income.

D) Walt must recognize income of $100,000; Jane has no income.

E) None of these.

Correct Answer:

Verified

Correct Answer:

Verified

Q44: A taxpayer transfers assets and liabilities to

Q45: When a taxpayer incorporates her business, she

Q46: Leah transfers equipment (basis of $400,000 and

Q47: Nancy, Guy, and Rod form Goldfinch

Q48: For transfers falling under § 351, what

Q50: The control requirement under § 351 requires

Q51: Because boot is generated under § 357(b)

Q52: Similar to the like-kind exchange provision, §

Q53: When consideration is transferred to a corporation

Q54: Alan, an Owl Corporation shareholder, makes a