Multiple Choice

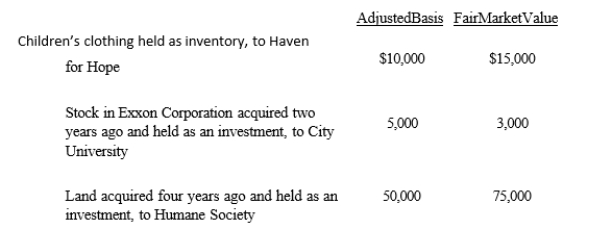

Owl Corporation (a C corporation) , a retailer of children's apparel, made the following donations to qualified charitable organizations this year.  How much qualifies for the charitable contribution deduction (ignoring the taxable income limitation) ?

How much qualifies for the charitable contribution deduction (ignoring the taxable income limitation) ?

A) $63,000

B) $65,000

C) $90,500

D) $92,500

E) None of these.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: During the current year, Gray Corporation, a

Q5: Luis is the sole shareholder of a

Q6: The passive loss rules apply to closely

Q7: Lilac Corporation incurred $4,700 of legal and

Q8: Plum Corporation (a C corporation and a

Q10: In the current year, Tern, Inc., a

Q11: Black, Inc., is a domestic corporation

Q12: Contrast the tax treatment of capital gains

Q13: Canary Corporation, a calendar year C corporation,

Q14: Violet, Inc., a closely held corporation (not