Essay

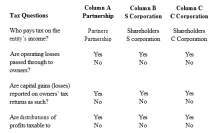

Compare the basic tax and nontax factors of doing business as a partnership, an S corporation, and a C

corporation. Circle the correct answers.

Correct Answer:

Verified

The correc...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

The correc...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q22: Code § 199A permits an individual to

Q54: A partnership will need to report wages

Q55: Which of the following statements is incorrect

Q56: Dawn is the sole shareholder of Thrush

Q58: Matt, the sole shareholder of Pastel Corporation

Q60: The QBI deduction percentage matches the 21%

Q61: Jason and Paula are married. They file

Q62: Carol and Candace are equal partners in

Q63: An individual in a specified service business,

Q64: Jansen, a single taxpayer, owns and operates