Multiple Choice

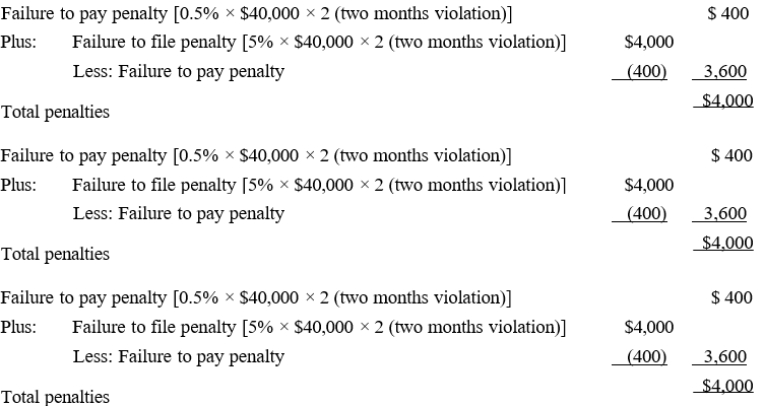

David files his tax return 45 days after the due date. Along with the return, David remits a check for $40,000. which is the balance of the tax owed. Disregarding the interest element, David's total failure to file and to pay penalties are:

A) $400.

B) $3,600.

C) $4,000.

D) $4,400.

E) None of these.

Correct Answer:

Verified

Correct Answer:

Verified

Q41: One of the motivations for making a

Q51: There is a Federal excise tax on

Q64: Because the law is complicated, most individual

Q72: Your client, Connie, won $12,000 in a

Q73: State and local governments are sometimes forced

Q73: Stealth taxes have the effect of generating

Q93: Which, if any, of the following provisions

Q130: The Federal excise tax on cigarettes is

Q132: Match the statements that relate to each

Q143: Using the following choices, show the justification