Short Answer

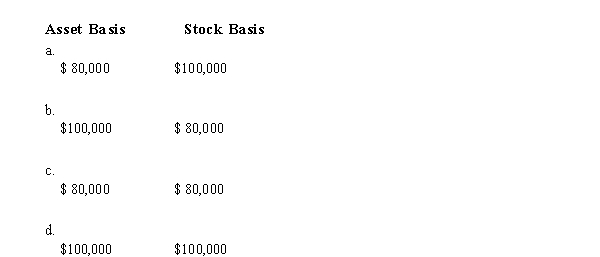

Chen contributes property with an adjusted basis of $80,000 and a fair market value of $100,000 to a newly formed business entity. If the entity is a C corporation and the transaction qualifies under § 351, the corporation's basis for the property and the shareholder's basis for the stock are:

Correct Answer:

Verified

Correct Answer:

Verified

Q19: To which of the following entities does

Q20: Mercedes owns a 30% interest in Magenta

Q21: Both Albert and Elva own 50% of

Q22: Candace, who is in the 32% tax

Q23: The Net Investment Income Tax NIIT) is

Q25: Techniques that can be used to minimize

Q27: List some techniques for reducing and/or avoiding

Q28: Match the following statements.<br>-Net capital loss<br>A)For the

Q29: Alice contributes equipment fair market value of

Q100: Match each of the following statements with