Short Answer

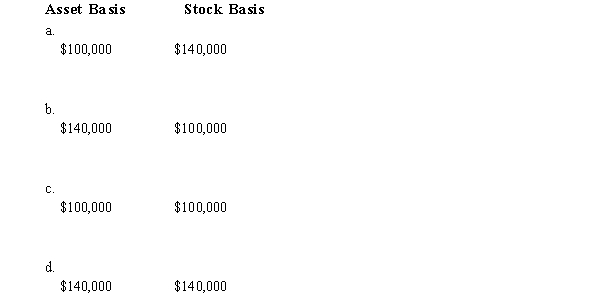

Martin contributes property with an adjusted basis of $100,000 and a fair market value of $140,000 to a newly formed business entity. If the entity is an S corporation and the transaction qualifies under § 351, the S corporation's basis for the property and the shareholder's basis for the stock are:

Correct Answer:

Verified

Correct Answer:

Verified

Q62: The AMT statutory rate for S corporation

Q64: Meg has an adjusted basis of $150,000

Q65: How can double taxation be avoided or

Q66: If an S corporation distributes appreciated property

Q68: In calculating the owner's initial basis for

Q69: A limited liability company LLC) is a

Q70: An individual who owes the NIIT cannot

Q71: Anne contributes property to the TCA Partnership,

Q82: Match the following attributes with the different

Q140: Match each of the following statements with