Multiple Choice

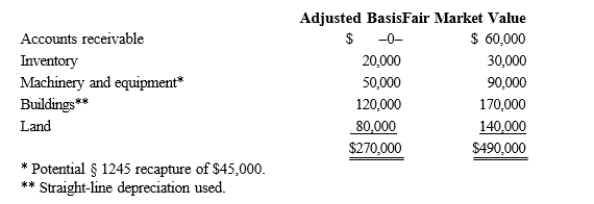

Albert's sole proprietorship owns the following assets.  Albert sells his sole proprietorship for $500,000. Calculate Albert's recognized gain or loss and classify it as capital or ordinary.

Albert sells his sole proprietorship for $500,000. Calculate Albert's recognized gain or loss and classify it as capital or ordinary.

A) $230,000 ordinary income.

B) $230,000 capital gain.

C) $115,000 ordinary income and $115,000 capital gain.

D) $110,000 ordinary income and $120,000 capital gain.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: A benefit of an S corporation when

Q2: Walter wants to sell his wholly owned

Q3: A limited partnership can indirectly avoid unlimited

Q6: Dudley holds a 20% ownership interest in

Q7: Do the at-risk rules apply to partnerships,

Q8: Myra is going to contribute the following

Q9: Match the following statements.<br>-Sale of the corporate

Q10: In the sale of a partnership, how

Q11: An S corporation election for Federal income

Q80: Match the following attributes with the different