Multiple Choice

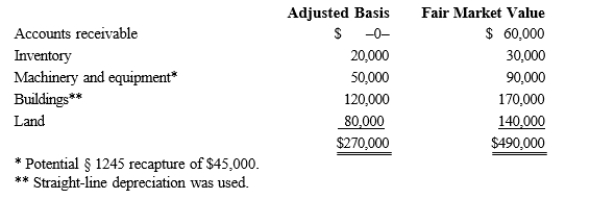

Kristine owns all of the stock of a C corporation which owns the following assets.  Her adjusted basis for her stock is $270,000. Calculate Kristine's recognized gain or loss and classify it as capital or ordinary if she sells her stock for $500,000.

Her adjusted basis for her stock is $270,000. Calculate Kristine's recognized gain or loss and classify it as capital or ordinary if she sells her stock for $500,000.

A) $230,000 ordinary income.

B) $230,000 capital gain.

C) $115,000 ordinary income and $115,000 capital gain.

D) $110,000 ordinary income and $120,000 capital gain.

Correct Answer:

Verified

Correct Answer:

Verified

Q27: List some techniques for reducing and/or avoiding

Q28: Match the following statements.<br>-Net capital loss<br>A)For the

Q29: Alice contributes equipment fair market value of

Q30: Techniques that may permit a C corporation

Q31: Transferring funds that are deductible by the

Q33: List some techniques that can be used

Q34: Blue, Inc., records taxable income before salary

Q35: Ralph wants to purchase either the stock

Q36: Ashley holds a 65% interest in a

Q37: Lee owns all the stock of