Essay

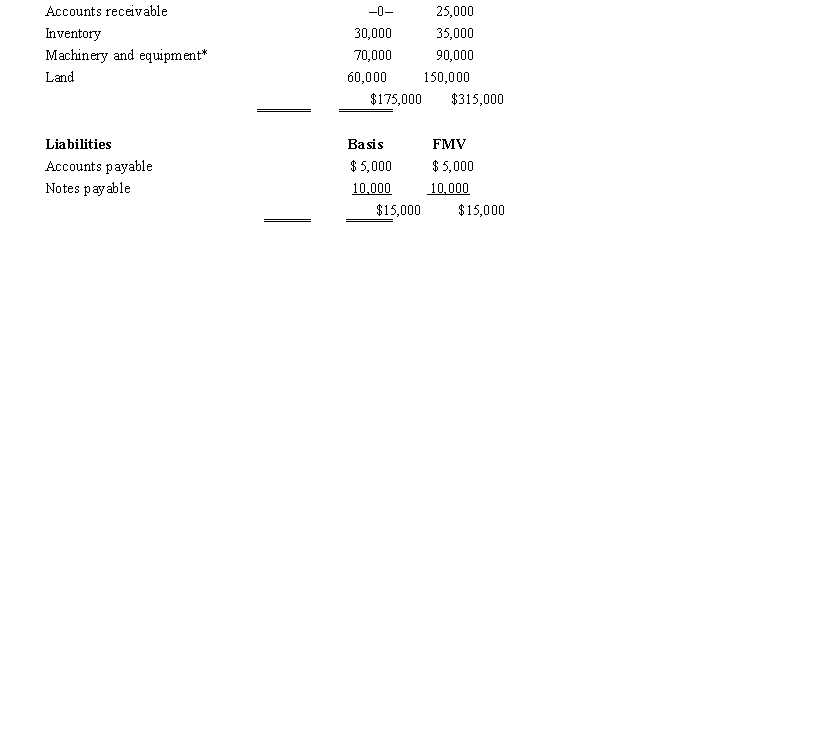

Luis owns all the stock of Silver, Inc., a C corporation for which his adjusted basis is $225,000. Luis founded Silver

12 years ago. The assets and liabilities of Silver are recorded as follows.  *Accumulated depreciation of $55,000 has been deducted.

*Accumulated depreciation of $55,000 has been deducted.

Luis has agreed to sell the business to Marilyn and they have agreed on a purchase price of $350,000 less any outstanding liabilities. They are both in the 35% tax bracket.

a. Advise Luis on whether the form of the sales transaction should be a stock sale or an asset sale.

b. Advise Marilyn on whether the form of the purchase transaction should be a stock purchases or an asset purchase.

Correct Answer:

Verified

a. Luis would prefer that the form of th...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q103: A corporation has a greater potential for

Q104: In the purchase of a partnership, how

Q105: Match the following statements.<br>-Sale of an ownership

Q106: A shareholder's basis in the stock of

Q107: The special allocation opportunities that are available

Q109: Arnold purchases a building for $750,000 that

Q110: The tax treatment of S corporation shareholders

Q112: Swallow, Inc., is going to make a

Q113: Both Malcomb and Sandra shareholders) loan Crow

Q140: Match each of the following statements with