Short Answer

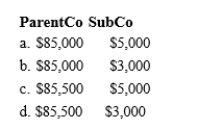

ParentCo and SubCo report the following items of income and deduction for the current year. ParentCo's SubCo's Taxable Item Taxable Income Income Income loss) from operations $100,000 $10,000)

§ 1231 loss 5,000)

Capital gain 15,000

Charitable contribution 12,000

Compute ParentCo and SubCo's taxable income or loss computed on a separate basis. Then compute the total of those amounts if appropriate.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: How are the members of a Federal

Q3: Generally, when a subsidiary leaves an ongoing

Q4: SubCo sells an asset to ParentCo at

Q5: Outline the major advantages and disadvantages of

Q6: After a takeover, the parent's balance sheet

Q7: ParentCo's separate taxable income was $200,000, and

Q8: Consolidated group members each are jointly and

Q9: The rules can limit the net operating

Q10: Within a Federal consolidated income tax group,

Q11: Match each of the following items with