Multiple Choice

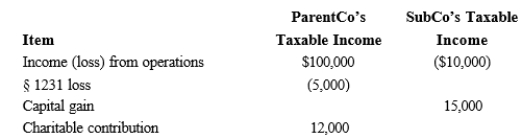

ParentCo and SubCo report the following items of income and deduction for the current year.  Compute ParentCo and SubCo's consolidated taxable income or loss.

Compute ParentCo and SubCo's consolidated taxable income or loss.

A) $81,000

B) $88,000

C) $90,000

D) $90,500

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q51: Subsidiary holds an allocated net operating loss

Q52: A subsidiary corporation must leave the consolidated

Q53: Deferring recognition of an intercompany gain is

Q54: The consolidated income tax return rules apply

Q55: A Federal consolidated filing group aggregates its

Q57: Forming a Federal consolidated tax return group

Q58: How must the IRS collect the liability

Q59: Consolidated estimated tax payments must begin for

Q60: All members of an affiliated group have

Q61: Business reasons, and not tax incentives, constitute