Short Answer

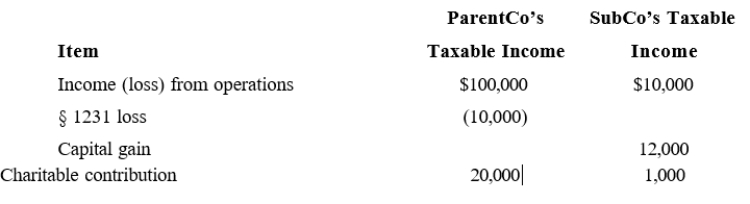

ParentCo and SubCo report the following items of income and deduction for the current year.  Compute ParentCo and SubCo's taxable income or loss computed on a separate basis.

Compute ParentCo and SubCo's taxable income or loss computed on a separate basis.

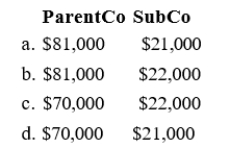

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q17: Match the following statements.<br>-Charitable contributions<br>A)For the corporate

Q69: A parent-subsidiary controlled group exists where there

Q70: Calendar year Parent Corporation acquired all

Q72: In computing consolidated E & P, dividends

Q73: Cooper Corporation joined the Duck consolidated Federal

Q75: Match each of the following terms with

Q76: Which of the following potentially is a

Q77: Parent Corporation's current-year taxable income included

Q78: A tax-exempt charitable trust created by a

Q79: When negative adjustments are made to the