Multiple Choice

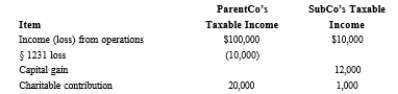

ParentCo and SubCo report the following items of income and deduction for the current year.  Compute ParentCo and SubCo's consolidated taxable income or loss.

Compute ParentCo and SubCo's consolidated taxable income or loss.

A) $91,000

B) $100,800

C) $112,000

D) $122,000

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q144: ParentCo owned 100% of SubCo for the

Q145: Cooper Corporation joined the Duck consolidated Federal

Q146: Match each of the following items with

Q147: Which of the following is not a

Q148: All affiliates joining in a newly formed

Q149: With the filing of its first consolidated

Q151: In terms of the consolidated return rules,

Q152: The starting point in computing consolidated taxable

Q153: Match each of the following terms with

Q154: The treatment of group items on a