Short Answer

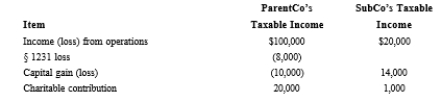

ParentCo and SubCo recorded the following items of income and deduction for the current tax year.  Compute ParentCo and SubCo's taxable income or loss computed on a separate basis. Then compute the total of those amounts if appropriate.

Compute ParentCo and SubCo's taxable income or loss computed on a separate basis. Then compute the total of those amounts if appropriate.

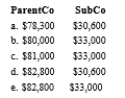

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q113: In computing consolidated taxable income, capital gains

Q114: For consolidated tax return purposes, purchased goodwill

Q115: Gold and Bronze elect to form a

Q116: Certain tax return items are computed on

Q117: If one member of an affiliated group

Q119: Match each of the following items with

Q120: Match each of the following terms with

Q121: The consolidated return rules combine the members'

Q122: List some of the nontax reasons that

Q123: Calendar year ParentCo purchased all of the