Essay

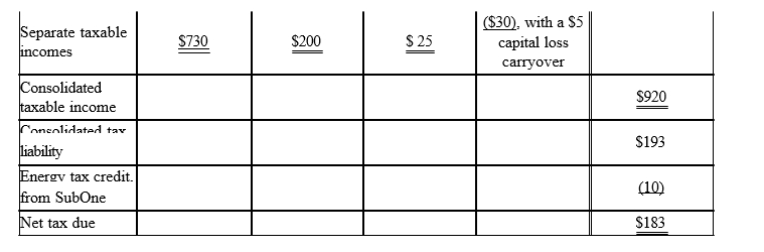

The Parent consolidated group reports the following results for the tax year. Determine each member's share of the consolidated tax liability, assuming that all members have consented to use the relative taxable income tax-sharing method. Dollar amounts are listed in millions, and a 21% income tax rate applies to all of the entities.

Correct Answer:

Verified

Consolidated tax lia...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q107: Match each of the following items with

Q108: When the parent acquires 51% of a

Q109: ParentCo's controlled group includes the following members.

Q110: In computing consolidated taxable income, the profit/loss

Q111: In computing consolidated taxable income, compensation amounts

Q113: In computing consolidated taxable income, capital gains

Q114: For consolidated tax return purposes, purchased goodwill

Q115: Gold and Bronze elect to form a

Q116: Certain tax return items are computed on

Q117: If one member of an affiliated group