Essay

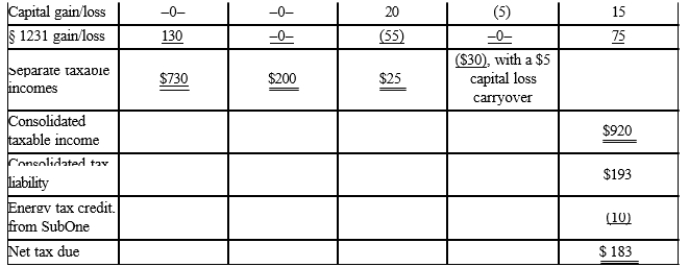

The Parent consolidated group reports the following results for the tax year. Determine each member's share of the consolidated tax liability, assuming that the members all have consented to use the relative tax liability tax-sharing method. Dollar amounts are listed in millions, and a 21% income tax rate applies to all of the entities.

Correct Answer:

Verified

Consolidated tax lia...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q17: Match the following statements.<br>-Charitable contributions<br>A)For the corporate

Q63: Certain business entities are ineligible to join

Q64: When a subsidiary sells to the parent

Q65: Which of the following potentially is a

Q66: Giant Ltd. owns 100% of the stock

Q67: Match each of the following items with

Q69: A parent-subsidiary controlled group exists where there

Q70: Calendar year Parent Corporation acquired all

Q72: In computing consolidated E & P, dividends

Q73: Cooper Corporation joined the Duck consolidated Federal