Essay

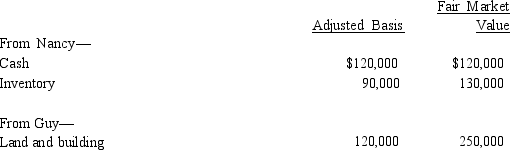

Nancy, Guy, and Rod form Goldfinch Corporation with the following consideration.

From Rod-

Legal and accounting services to incorporate

Goldfinch issues its 500 shares of stock as follows: 250 to Nancy, 200 to Guy, and 50 to Rod. In addition, Guy gets

$50,000 in cash.

a. Does Nancy, Guy, or Rod recognize gain or income)?

b. What basis does Guy have in the Goldfinch stock?

c. What basis does Goldfinch Corporation have in the inventory? In the land and building?

d. What basis does Rod have in the Goldfinch stock?

Correct Answer:

Verified

gain. Rod has ordinary income of $50,000...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q38: Adam transfers cash of $300,000 and land

Q41: In a § 351 transaction, if a

Q43: A shareholder contributes land to his wholly

Q46: Leah transfers equipment (basis of $400,000 and

Q62: A long-term note is treated as "boot."

Q93: One month after Sally incorporates her sole

Q98: Four individuals form Chickadee Corporation under

Q100: Rob and Yi form Bluebird Corporation

Q100: Mitchell and Powell form Green Corporation. Mitchell

Q104: What are the tax consequences if an