Multiple Choice

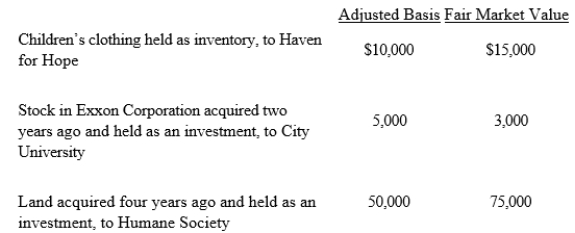

Owl Corporation a C corporation) , a retailer of children's apparel, made the following donations to qualified charitable organizations this year.  How much qualifies for the charitable contribution deduction ignoring the taxable income limitation) ?

How much qualifies for the charitable contribution deduction ignoring the taxable income limitation) ?

A) $63,000

B) $65,000

C) $90,500

D) $92,500

E) None of these.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: In tax planning for charitable contributions, a

Q28: In working with Schedule M-2 (analysis of

Q45: On December 31, 2019, Flamingo, Inc., a

Q59: Warbler Corporation, an accrual method regular

Q61: In connection with the deduction for startup

Q62: Thrush Corporation, a calendar year C corporation,

Q67: In each of the following independent

Q81: In 2019, Bluebird Corporation had net income

Q89: Elk, a C corporation, has $370,000 operating

Q91: Hornbill Corporation, a cash basis and calendar