Multiple Choice

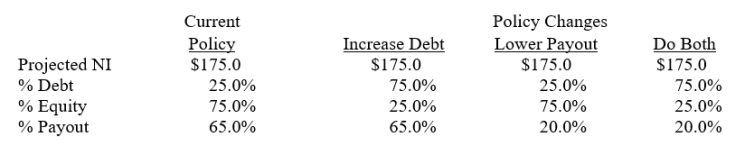

Del Grasso Fruit Company has more positive NPV projects than it can finance under its current policies without issuing new stock, but its board of directors had decreed that it cannot issue any new shares in the foreseeable future. Your boss, the CFO, wants to know how the capital budget would be affected by changes in capital structure policy and/or the target dividend payout policy. You obtained the following data, which shows the firm's projected net income (NI) , its current capital structure and dividend payout policies, and three possible new policies. Projected net income for the coming year will not be affected by a policy change. How much larger could the capital budget be if (1) the target de ratio were raised to the indicated amount, other things held constant, (2) the target payout ratio were lowered to the indicated amount, other things held constant, or (3) the debt ratio and dividend payout were both changed by the indicated amounts?

A) $133.0; $ 85.5; $389.6

B) $140.0; $ 90.0; $410.1

C) $147.4; $ 94.8; $431.7

D) $155.2; $ 99.8; $454.4

E) $163.3; $105.0; $478.3

Correct Answer:

Verified

Correct Answer:

Verified

Q4: The federal government sometimes taxes dividends and

Q26: If investors prefer firms that retain most

Q29: New Orleans Builders Inc. has the following

Q31: Chicago Brewing has the following data,

Q35: Torrence Inc. has the following data.

Q45: Which of the following statements is CORRECT?<br>A)

Q56: Miller and Modigliani's dividend irrelevance theory says

Q66: There are two types of dividend reinvestment

Q68: Which of the following actions will best

Q71: One advantage of dividend reinvestment plans is