Multiple Choice

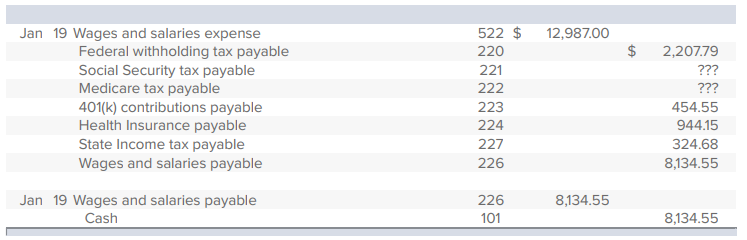

The following data is for the January 19 pay date for Waryzbok Inc.:

Which of the following represents the missing Social Security and Medicare taxes, assuming that the health insurance is qualified under Section 125?

A) Social Security tax, $204.15; Medicare tax, $792.35

B) Social Security tax, $792.35; Medicare tax, $204.15

C) Social Security tax, $746.66; Medicare tax, $174.62

D) Social Security tax, $188.31; Medicare tax, $805.19

Correct Answer:

Verified

Correct Answer:

Verified

Q46: What is the primary purpose of a

Q47: Which of the following is an example

Q48: Besides containing the supporting data for periodic

Q49: Two complete payroll-related General Journal entries are

Q50: How does a payroll accountant keep track

Q52: Which of the following is an example

Q53: How does the payroll register connect with

Q54: Mandatory employer-paid payroll taxes are known as

Q55: What is true about the trial balance?<br>A)The

Q56: In what order are accounts presented on