Multiple Choice

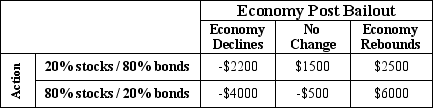

Estimated profits for an investor would depend on how successful a bailout bill would be in helping the U.S.economy.The estimated annual return for two different investment strategies are shown in the following table.If there is a 30% chance that the economy will decline, 50% that there will be no change and 20% chance that it will rebound, the standard deviation associated with the investment strategy of allocating 80% to stocks and 20% to bonds is ________________________ .

A) $1782

B) $2245

C) $2567

D) $3473

E) $4500

Correct Answer:

Verified

Correct Answer:

Verified

Q166: Which of those variables about German Shepherds

Q167: Double-blinding in experiments is important so that

Q168: A customer service center keeps track of

Q169: A major customer for a vendor of

Q170: A regression analysis of company profits and

Q172: An advocacy group is investigating whether gender

Q173: Real estate agencies keep track of housing

Q174: As a result of the financial crisis

Q175: A least squares estimated regression line has

Q176: Which of the following statements about a