Multiple Choice

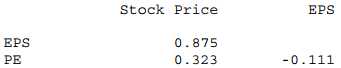

Shown below is a correlation table showing correlation coefficients between stock price, earnings per share (EPS) and price/earnings (P/E) ratio for a sample of 19 publicly traded companies.Which of the following statements is false?

Correlations: Stock Price, EPS, PE

A) EPS is the best predictor of stock price.

B) The strongest correlation is between EPS and stock price.

C) There is a weak negative association between PE and EPS.

D) PE is the best predictor of stock price.

E) The weakest correlation is between PE and EPS.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: A study examined consumption levels of oil

Q12: For the following scatterplot,<br><img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7786/.jpg" alt="For the

Q13: Suppose the correlation, r, between two variables

Q13: A company studying the productivity of their

Q14: Suppose the correlation, r, between two variables

Q15: A small independent organic food store offers

Q17: Data were collected on monthly sales revenues

Q18: The disadvantage of re-expressing variables is that

Q20: Linear regression was used to describe the

Q21: A consumer research group examining the relationship