Multiple Choice

Figure 27-1

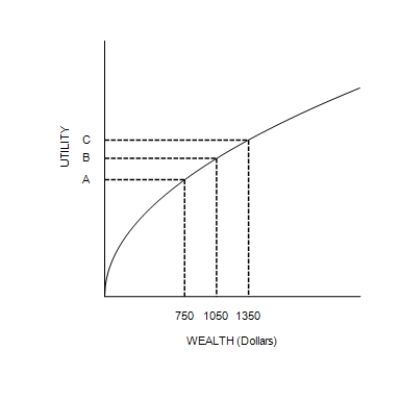

The following figure shows a utility function for Ren.

-Refer to Figure 27-1. From the appearance of the utility function, we know that

A) if Ren owns a house, he would not consider buying fire insurance.

B) Ren would prefer to hold a portfolio of stocks with an average return of 6 percent and a standard deviation of 1 percent to a portfolio of stocks with an average return of 6 percent and a standard deviation of 5 percent.

C) Ren would prefer to hold a portfolio of stocks with an average return of 8 percent and a standard deviation of 5 percent to a portfolio of stocks with an average return of 6 percent and a standard deviation of 3 percent.

D) Ren is not risk averse.

Correct Answer:

Verified

Correct Answer:

Verified

Q90: What does "random walk" mean? According to

Q91: What's the difference between firm-specific risk and

Q92: Suppose the interest rate is 3% and

Q93: Why might someone be willing to pay

Q94: Historically, stocks have offered higher rates of

Q96: Figure 27-3<br>The following figure shows a utility

Q97: You have a choice among three options.

Q98: The relation between return and risk.

Q99: If you are faced with the choice

Q100: A company has an investment project that