Multiple Choice

Figure 8-1

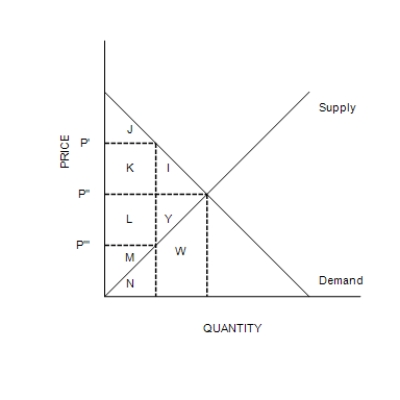

-Refer to Figure 8-1. Suppose the government imposes a tax of P'-P'''. The area measured by L + M + Y represents

A) consumer surplus after the tax.

B) consumer surplus before the tax.

C) producer surplus after the tax.

D) producer surplus before the tax.

Correct Answer:

Verified

Correct Answer:

Verified

Q170: The optimal tax is difficult to determine

Q171: Figure 8-10<br><br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7555/.jpg" alt="Figure 8-10

Q172: The Social Security tax is a labor

Q173: Figure 8-1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7555/.jpg" alt="Figure 8-1

Q174: The Laffer curve illustrates how taxes in

Q176: Suppose the demand curve and the supply

Q177: Taxes create deadweight losses.

Q178: Figure 8-2<br>The vertical distance between points C

Q179: Figure 8-10<br><br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7555/.jpg" alt="Figure 8-10

Q180: Refer to Scenario 8-3. Suppose that